Why Invest in CCLF?

By investing with CCLF, you share tangibly in financing positive change in low- and moderate-income communities across the six counties of metropolitan Chicago. CCLF prudently manages your investment while underwriting community projects in affordable and supportive housing, social services, social enterprises and economic development projects that provide employment opportunities and goods and services for neighborhood residents.

Management Quality

CCLF is guided by a talented governance board, whose members possess a wide range of expertise and experience related to the many aspects of community development. The organization also benefits from strong credit, risk management and finance committees and a professional management team. CCLF’s cumulative charge-off ratio is less than one percent. Over the past year, CCLF has maintained an average self-sufficiency ratio of 91% and anticipates that the lending program will continue to achieve this ratio in the future.

Investment Opportunities

The Chicago Community Loan Fund (CCLF) offers a variety of impactful investment opportunities through our General Loan Pool and Communities of Color Fund. Explore the options below to learn how your investment can support community development across Chicagoland. We also welcome you to connect with us directly for more information.

General Loan Pool Investments

Investments in CCLF’s General Loan Pool may be made as senior or subordinated (EQ2) debt. These funds are distributed across all of CCLF’s asset classes and sectors, allowing our team to deploy capital where it’s needed most throughout Chicagoland.

Minimum investment: $1,500.

Communities of Color Fund Investments

CCLF created the Communities of Color Fund to further our commitment in low-to-moderate-income neighborhoods. This $15 million fund provides lower-cost capital to high-impact projects serving communities of color.

Minimum investment: $1,500 | Interest rate: 2% or below | Minimum term: 3 years.

Capital Grants

Capital grants are essential to strengthening CCLF’s balance sheet and expanding our ability to accept and deploy investments. These grants not only enable us to attract new capital but also support a robust pipeline of community-focused projects.

All capital grants are restricted for use as lending capital only—never for operations—and are welcome in any amount.

“CCLF is able to leverage capital grants at a 3:1 ratio, continuing to bring critical resources to Chicagoland communities. Without this support, we would not have grown into a $200 million+ organization.”

— Angela Dowell, CFO

How It Works

Investors who want to make a positive social impact accept a below-market return—typically 0 to 2.5 percent—in exchange for a social dividend. The spread between the below-market rate and what CCLF earns on our community investments helps to offset operating costs. Investment terms range from one to 15 years, and interest is typically paid semi-annually.

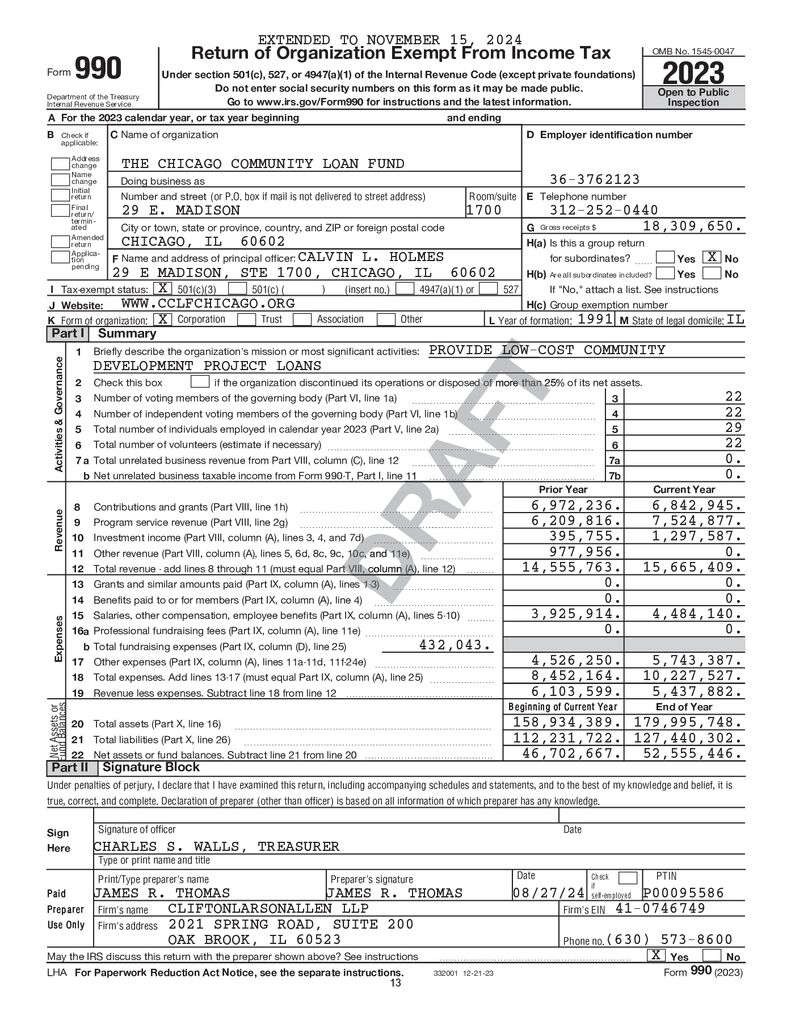

Financials

Our investors include banks and corporations, foundations, religious institutions, public sector agencies and individuals. Investments range from a minimum of $1,500 to $8 million or more, yet nearly half of CCLF’s investors are individuals and families who want part of their investment portfolio to help create communities where people thrive. All investments—small and large—are vital to continue our work.

Please contact us if you have any questions about our financial statements featured below.

2024 Annual Financial Report

View/Download

2023 Annual Financial Report

View/Download

2022 Annual Financial Report

View/Download

2021 Annual Financial Report

View/Download