Chicago Community Loan Fund (CCLF) plays a unique role in community development throughout Chicagoland: our loans often fill credit gaps that few other lenders can or will cover, such as complete financing for very small projects or gaps in larger projects.

CCLF is often the first lender to finance a compelling community development project, making a critical difference in whether it moves forward—or not. Our energy and patience allow us to champion challenging, but high-impact projects. Typically, our early loans pave the way for additional financing from other lenders and funders.

We don’t just do loans. We roll up our sleeves and provide customized technical assistance and support to help local visionaries succeed. Organizations discover new resources and grow by working with us. We particularly encourage the use of sustainable building practices in projects we finance.

A RECORD OF GROWTH AND RESULTS

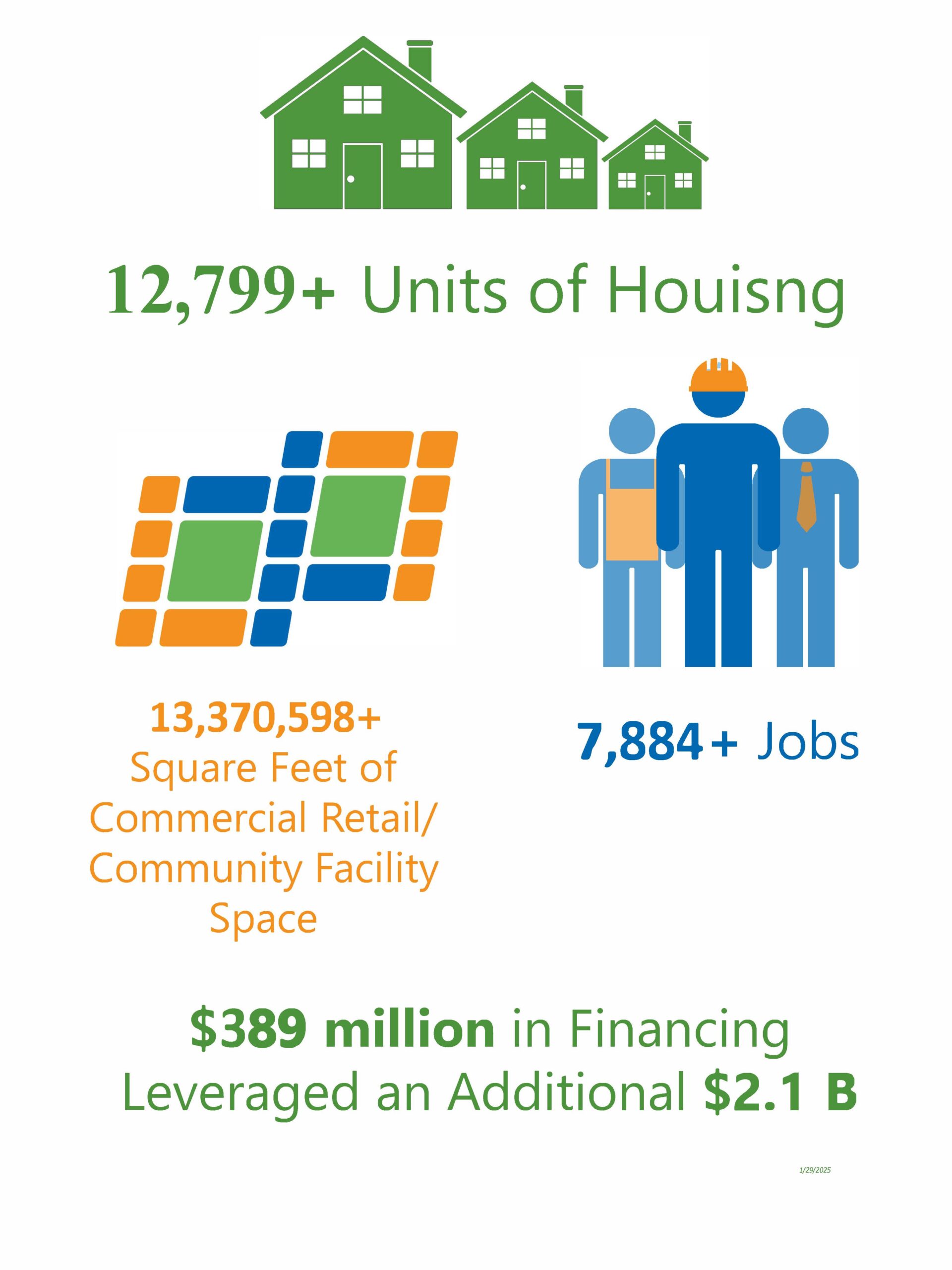

Since its founding in 1991, CCLF has grown from an initial investment of $200,000 to more than $200 million in assets. The impact of that investment has resulted in:

MANAGEMENT QUALITY

CCLF is guided by a talented governance board, whose members possess a wide range of expertise and experience related to the many aspects of community development. The organization also benefits from strong credit, risk management and finance committees and a professional management team. CCLF’s cumulative charge-off ratio is less than one percent. Over the past year, CCLF has maintained an average self-sufficiency ratio of 91% and anticipates that the lending program will continue to achieve this ratio in the future.