Two years after the start of the pandemic, CCLF’s 2022 Stakeholders Meeting was held virtually for the third time due to the continued threat of COVID-19.

The goals of the meeting were to provide Stakeholders with an update on CCLF’s lending, portfolio and finances so Stakeholders can continue to have confidence in working with CCLF as a funding partner.

The day began with a welcome from the emcee, Lycrecia Parks , CCLF’s Chief Risk Officer and Vice President of Portfolio Management.

Vice President of Portfolio Management

She continued to outline the day’s agenda and provided the audience with a snapshot of CCLF’s portfolio and loans. The outstanding portfolio balance as of year-end 2021 was at $92.7 million and grew to $98.2 million by 3/31/2022. She reported delinquencies were at zero percent in 2021 and currently are at .4 percent. CCLF closed 32 loans at 12/31/2021, totaling $27.8 million.

Calvin Holmes moderated a panel with CCLF Board members Matt Reilein, Chair; Jennifer Guzman, Human Resources Committee Chair and Erik Hall, Vice Chair.

Reilein focused on CCLF’s lending goals indicating CCLF will step up to promote economic justice and advance equity by lending $100 million in low- and moderate-income communities of color and continue striving to nearly doubling its size to $200 million in assets by 2024. Guzman talked about improvements made to the human resource policies to help retain and attract staff and the new Diversity Equity and Inclusion framework approved by the Board. Hall shared the steps taken to mitigate risks during the pandemic, future unforeseen crises and beyond.

Angela Dowell, CCLF’s Chief Financial Officer, moderated a panel of investors with Tony Smith, PNC Bank, SVP/ Community Development – Territory Executive and Ayesha Jaco, West Side United, Executive Director .

Angela provided the FY 2021 audit results and first quarter current assets and income statement. CCLF ended 2021 with $141 million in assets and had a surplus of $9.2 million with the majority of these funds earmarked as lending capital. A copy of the audit was made available in the chat during the meeting. Tony Smith and Ayesha Jaco complimented CCLF, noting that they invest in CCLF because CCLF’s work aligns with their racial equity goals.

Bob Tucker, CCLF’s Chief Operating Officer and Executive Vice President of Programs, moderated a program panel with Charlie Corrigan, JPMorgan Chase, Executive Director – Central Region Philanthropy with and Will Edwards, Chicago Department of Housing, Deputy Commissioner for Housing Preservation.

Corrigan discussed the importance of the Chicagoland Opportunity Zone Consortium, and Edwards highlighted the great work being accomplished by the Chicago Neighborhood Rebuild Program. CCLF administers both programs and received high praise as the lead partner.

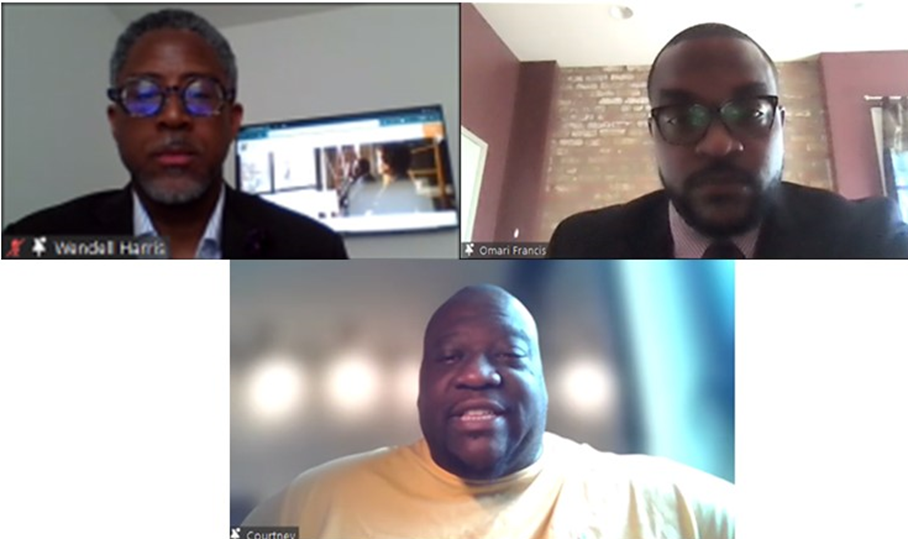

Wendell Harris, CCLF, Vice President of Lending Operations, moderated a borrowers panel with CEO Courtney Jones, CEO of Black Coalition for Housing (a CCLF borrower) and Omari Frances, owner of Karnac (another CCLF borrower).

The borrowers shared past obstacles encountered trying to secure financing as a Black developer. They shared how CCLF was a patient lender providing technical assistance along the way and how they plan to build their portfolio and return to CCLF for financing of their future projects.

The meeting concluded with questions and answers and Holmes thanking all stakeholders for attending and for their commitment to making capital available to developers of color so they can improve historically disadvantaged neighborhoods throughout Chicagoland.