After putting the worst of the pandemic behind us, 2022 was an outstanding year for CCLF to satisfy its mission of “providing flexible, affordable and responsible financing and technical assistance for community stabilization and development efforts and initiatives that benefit low- to moderate-income neighborhoods, families and individuals throughout metropolitan Chicago.”

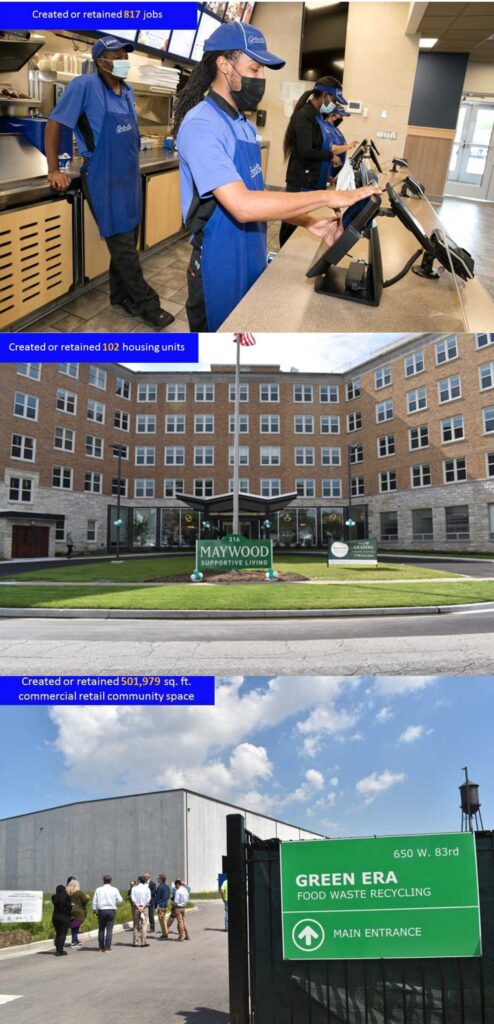

CCLF closed 26 loans totaling $33,449,000 which created or retained 102 housing units and developed and retained 501,979 square feet of commercial real estate and community facility space. The number of jobs created or retained by our borrowers totaled 817. Forty-two technical assistance workshops took place in 2022 reaching 1,327 participants, and an additional 447 individuals were assisted with information and referrals.

Since its origination in 1991, CCLF has closed 602 loans totaling over $314 million in financing which has leveraged more than $1.7 billion.

CCLF’s $25 million Communities of Color Fund was added to CCLF’s lending capabilities in FY 2022 as another tool to address racial equity in low- to moderate-income neighborhoods throughout Chicagoland. CCLF financed 14 projects totaling $10 million. Closing out the year, CCLF’s President, Calvin L. Holmes, was recognized by Crain’s Chicago Business as one of the Notable Leaders in Community Development, and CCLF’s Board Chair, Mathew Reilein, was named a Notable Nonprofit Board Leader.

CCLF’s AERIS® RATING remained at AA ★★★ showing strong alignment of its impact mission, strategies, activities, and data that guide its lending, programs and planning. This rating also shows CCLF led initiatives to change government policy to benefit the community development finance industry or disadvantaged people and communities. The Chicagoland Opportunity Zones Consortium, which is housed at CCLF, assisted 44 entities/individuals with guidance and matchmaking and made 66 introductions to prospective Opportunity Zones investors reflecting 31 opportunities. Finally, CCLF ended the year with 184 borrowers on portfolio and an outstanding principal balance of $107 million and $154 million in total assets.